Preparing statutory financial reports is a mandatory responsibility for businesses, yet it remains one of the most demanding tasks for finance teams. Statutory financial statements—including balance sheets, profit and loss statements, cash flow statements, and detailed disclosures—must present a true and fair view of an organization’s financial position while strictly complying with regulatory frameworks such as IFRS, GAAP, or local accounting standards.

For many organizations, especially those managing multiple entities, currencies, or jurisdictions, statutory reporting can become overwhelming when handled through traditional, manual processes. Errors, delays, compliance risks, and audit challenges are common pain points. Today, intelligent digital platforms like Result Lane are transforming statutory financial reporting by introducing automation, accuracy, and actionable insights into what was once a highly manual process.

Why Statutory Financial Reporting Is Business-Critical

Statutory financial reports are not just compliance documents; they are a foundation of trust and transparency. Regulators, investors, auditors, and other stakeholders rely on these statements to assess financial performance, stability, and governance.

Failure to produce accurate statutory reports can result in regulatory penalties, reputational damage, audit complications, and poor decision-making. As regulations grow more complex and reporting timelines tighten, businesses can no longer rely on spreadsheets and disconnected systems to meet statutory obligations effectively.

Limitations of Traditional Statutory Reporting Methods

Despite technological advancements in finance, many organizations still depend on outdated reporting methods. These approaches often create significant operational challenges:

1. Heavy Dependence on Manual Processes

Finance teams frequently spend countless hours consolidating data from multiple systems, spreadsheets, and subsidiaries. Manual data handling significantly increases the risk of inconsistencies and human errors.

2. Extended Reporting Cycles

Manual reconciliations, approvals, and formatting slow down the reporting process. Missed deadlines become more likely, especially during peak reporting periods such as year-end closures.

3. Regulatory Complexity

Keeping up with changing accounting standards and statutory formats is difficult without automated validation. Even minor non-compliance issues can trigger audit flags or penalties.

4. Limited Financial Insight

Traditional reports often provide static numbers with little analytical depth. Finance leaders are left without real-time insights into performance, liquidity, or trends.

5. Audit and Documentation Challenges

Without proper audit trails, tracking changes, approvals, and data sources becomes difficult—making audits stressful and time-consuming.

These challenges highlight the urgent need for a smarter, more streamlined approach to statutory financial reporting.

The Role of Digital Transformation in Statutory Reporting

Modern digital platforms are reshaping how organizations manage statutory financial statements. By combining automation, artificial intelligence, and cloud-based collaboration, these tools significantly reduce complexity and improve reliability.

Automated Data Integration

Digital solutions seamlessly pull financial data from ERP systems, accounting software, and other data sources. This eliminates repetitive manual entry and ensures consistency across all reports.

Intelligent Error Detection

AI-driven validation identifies discrepancies, missing data, and unusual trends in real time. Finance teams can resolve issues early, preventing last-minute corrections and inaccurate filings.

Built-In Compliance Frameworks

Digital statutory reporting platforms come equipped with pre-configured templates aligned with IFRS, GAAP, and jurisdiction-specific regulations. This ensures that reports meet statutory requirements without constant manual checks.

Real-Time Collaboration

Cloud-based accessibility allows finance, accounting, and audit teams to collaborate simultaneously. Version control and role-based access ensure accuracy while maintaining data security.

Insight-Driven Reporting

Beyond compliance, advanced dashboards and analytics provide valuable insights into financial performance, enabling leadership teams to make informed, strategic decisions.

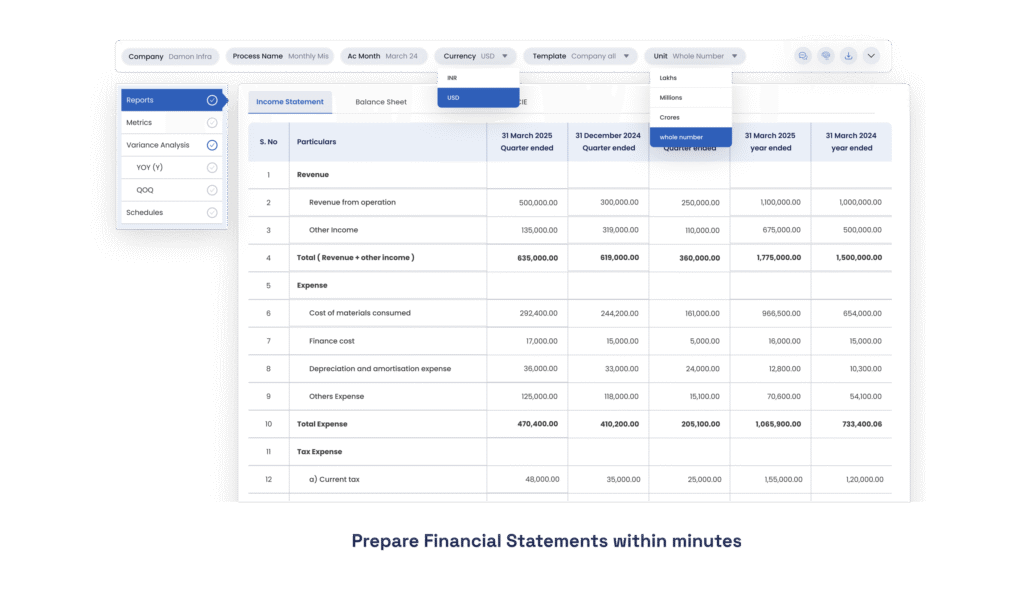

How Result Lane Enhances Statutory Financial Reporting

Result Lane’s Statutory Financial Reporting solution is designed to simplify compliance while empowering finance teams with accuracy and visibility. The platform supports businesses at every stage of the statutory reporting lifecycle.

Key Capabilities Include:

- End-to-End Automation

From data collection to final report generation, Result Lane automates the entire statutory reporting process, significantly reducing manual effort. - AI-Based Data Validation

The system detects inconsistencies, anomalies, and missing entries across multiple entities and periods, ensuring reliable financial statements. - Compliance-Ready Reporting

Built-in regulatory checks and standardized formats help businesses meet IFRS, GAAP, and local statutory requirements with confidence. - Flexible Report Customization

Finance teams can tailor statutory reports for regulators, auditors, investors, or internal stakeholders without duplicating work. - Real-Time Dashboards and Analytics

Interactive visuals provide insights into profitability, cash flow, and financial trends, turning statutory data into a strategic asset. - Audit-Ready Documentation

Automated audit trails track every change, approval, and data source, making audits smoother and more transparent.

By reducing complexity and manual dependency, Result Lane allows finance teams to shift focus from data preparation to financial analysis and strategic planning.

Business Benefits of Digital Statutory Reporting

Organizations that adopt intelligent statutory reporting platforms experience measurable advantages:

- Higher Accuracy and Reliability

Automation minimizes errors and ensures consistent financial data across reports. - Faster Reporting Timelines

Shorter close cycles help businesses meet statutory deadlines without stress. - Improved Regulatory Compliance

Built-in compliance frameworks reduce the risk of penalties or audit findings. - Better Financial Visibility

Real-time insights support informed decision-making at the leadership level. - Improved Team Collaboration

Cloud-based workflows enhance coordination between finance, audit, and compliance teams. - Audit Confidence

Clear documentation and traceability simplify audits and regulatory reviews.

Best Practices for Effective Digital Statutory Reporting

To maximize the value of digital statutory reporting, organizations should:

- Centralize financial data across systems

- Automate repetitive reconciliation and consolidation tasks

- Regularly update compliance rules within the platform

- Train finance teams for effective adoption

- Conduct periodic reviews to enhance accuracy and insights

Conclusion

Statutory financial reporting no longer needs to be a time-consuming, high-risk process. With intelligent automation and AI-driven validation, businesses can transform statutory reporting into a streamlined, accurate, and insight-rich function.

Platforms like Result Lane enable organizations to meet compliance requirements confidently while gaining real-time visibility into their financial performance. By investing in digital solutions for Statutory Financial Statements, businesses can reduce errors, accelerate reporting cycles, and empower finance teams to focus on strategic growth rather than administrative complexity.

In an increasingly regulated and data-driven business environment, modern statutory reporting is not just an advantage—it is a necessity.