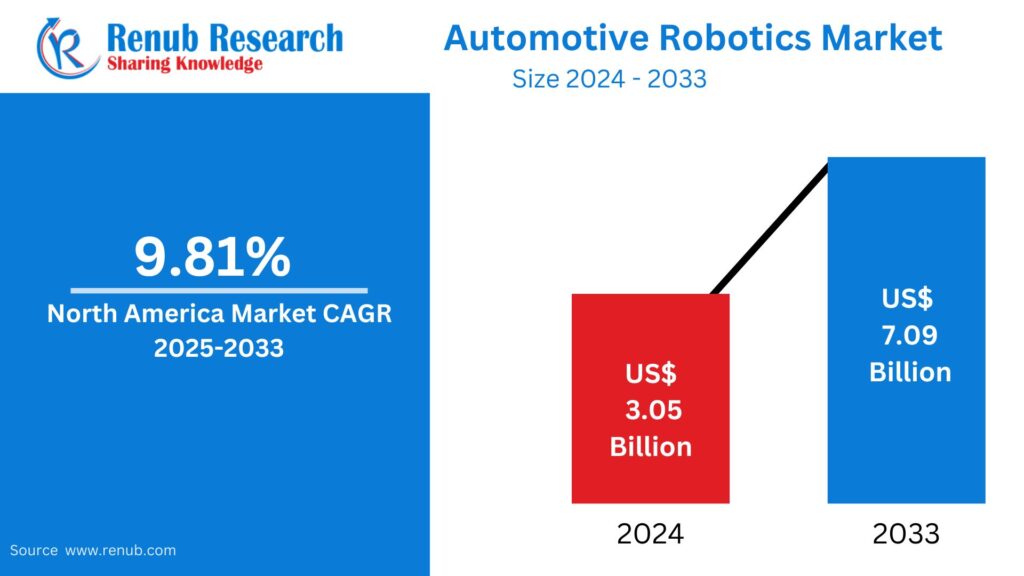

North America Automotive Robotics Market Size and Forecast (2025–2033)

According to Renub Research North America Automotive Robotics Market is projected to reach US$ 7.09 billion by 2033, rising from US$ 3.05 billion in 2024, at a strong CAGR of 9.81% from 2025 to 2033. Market growth is being accelerated by the surging demand for automation, advancements in AI and machine learning, increasing Industry 4.0 implementation, reduced labor costs, rising production efficiency requirements, and increasing precision manufacturing needs.

The North America Automotive Robotics Market Report evaluates the market across Components (Controller, Robotic Arm, End Effector, Sensors, Drives), Robot Types (Articulated, Cylindrical, SCARA, Cartesian), Applications (Material Handling, Welding, Painting, Cutting), Regional Markets (U.S., Canada, Mexico), and Leading Company Analysis for the forecast period 2025–2033.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=north-america-automotive-robotics-market-p.php

North America Automotive Robotics Industry Overview

Automotive robotics refers to the integration of automated robotic systems, machines, and AI-driven technologies in vehicle production and assembly. Robots perform essential manufacturing operations such as:

- Welding

- Painting

- Material handling

- Assembly

- Inspection & quality control

- Cutting & machining tasks

By automating these functions, automotive manufacturers benefit from:

- Reduced operational errors

- Lower labor expenses

- Enhanced efficiency and consistency

- Improved production precision

- Safer working environments

The adoption of AI, machine learning, vision sensors, real-time monitoring systems, and IoT connectivity has significantly improved robotic functionality. These capabilities enable robots to perform high-complexity tasks, adapt to dynamic production needs, and support the transformation toward Industry 4.0 smart manufacturing environments.

North America’s automotive sector—marked by the rapid growth of electric vehicles (EVs), autonomous vehicle development, digital manufacturing transformation, and competitive production standards—is increasingly dependent on robotic technologies to maintain global competitiveness and ensure sustainable manufacturing excellence.

Key Growth Drivers for the North America Automotive Robotics Market

Increasing Demand for Automation

Automation remains one of the strongest catalysts driving robotic deployment in the North American automotive industry. Manufacturers are increasingly investing in robotics to:

- Improve production speed

- Enhance precision levels

- Lower labor dependency

- Reduce manufacturing costs

- Meet high vehicle quality standards

Automation enables high-volume production while minimizing human error and enhancing workplace safety. A notable example is ABB’s December 2023 agreement with Volvo Cars, where ABB supplied 1,300 advanced industrial robots to support Volvo’s next-generation electric vehicle production. Robots such as IRB 6710, 6720, and 6730 now perform critical roles including welding, dispensing, and riveting—emphasizing the rising reliance on robotics in EV manufacturing.

Technological Advancements in Robotics

Technological innovation plays a crucial role in strengthening the North American automotive robotics landscape. Rapid advancements in:

- Artificial Intelligence (AI)

- Machine Learning

- Machine Vision Technology

- Advanced Sensors

- Autonomous Mobile Robots (AMRs)

have significantly improved robotic accuracy, flexibility, and learning capabilities. These developments allow robots to execute complex manufacturing processes faster, more precisely, and more efficiently—key requirements for EV and intelligent vehicle production.

A key example occurred in September 2023, when ABB showcased advanced robotic solutions, AMRs, and collaborative robots at Automate 2023 in Detroit, demonstrating the future of smart automotive manufacturing.

Safety Improvements and Workforce Protection

Workplace safety has become a primary priority in the automotive manufacturing industry. Robotics significantly reduce risks by minimizing human involvement in hazardous tasks such as:

- Welding

- Heavy lifting

- Operations involving heat or chemical exposure

Collaborative robots (cobots) are becoming increasingly popular, working safely alongside human workers without requiring extensive safety barriers. A strong example includes Kawasaki Robotics’ launch of CL Series intelligent cobots in September 2024, designed to enhance safety, precision, and efficiency in automotive assembly environments.

Stricter safety regulations and corporate focus on workforce protection further drive robotic automation adoption.

Challenges in the North America Automotive Robotics Market

High Initial Investment

Despite notable benefits, automation adoption is hindered by high installation costs. Expenses associated with:

- Purchasing industrial robots

- Integration into existing production systems

- Infrastructure upgrades

- Maintenance

- Skilled workforce training

can be substantial, especially for small and mid-sized automotive suppliers. Although long-term productivity gains and cost savings are significant, upfront capital requirements remain a major barrier.

Regulatory and Compliance Challenges

Manufacturers must comply with a complex network of safety, automation, and labor regulations across North America. Compliance with standards such as:

- OSHA regulations

- ISO robotic safety standards

- Regional manufacturing compliance laws

requires ongoing monitoring, audits, and occasional costly operational adjustments. Non-compliance risks include heavy penalties, operational shutdowns, and legal consequences—adding financial and administrative burdens to robotic deployment.

North America Country Market Insights

United States Automotive Robotics Market

The United States leads North America in automotive robotics deployment due to:

- Strong automotive manufacturing base

- Growing EV production investments

- Rising focus on automated precision manufacturing

Technological innovation is rapidly enhancing robotic capabilities in American factories. In March 2023, ABB invested US$ 20 million to expand its Michigan robotics facility, strengthening domestic manufacturing capacity and supporting advanced automation across the automotive sector.

Canada Automotive Robotics Market

Canada is witnessing accelerating adoption of robotics in automotive manufacturing. Growing EV manufacturing initiatives, strong industrial modernization programs, and rising demand for precision engineering support robotic integration.

Canadian automakers increasingly rely on robotics to:

- Improve production throughput

- Enhance vehicle assembly accuracy

- Strengthen safety compliance

- Maintain international competitiveness

Despite challenges like high investment costs and skilled workforce shortages, robotics continues to reshape Canada’s automotive production landscape.

Mexico Automotive Robotics Market

Mexico has rapidly emerged as a major automotive manufacturing hub, with strong integration of robotics across production lines. Robotics adoption is accelerating due to:

- Expansion of vehicle assembly plants

- Rising EV production needs

- Growing participation in global automotive supply chains

Automation enhances manufacturing productivity, supports export competitiveness, and strengthens quality assurance. Although investment costs and workforce skill gaps remain challenges, Mexico is expected to sustain strong robotic adoption in the coming years.

North America Automotive Robotics Market Segmentation

By Component

- Controller

- Robotic Arm

- End Effector

- Sensors

- Drive

- Others

By Robot Type

- Articulated Robots

- Cylindrical Robots

- SCARA Robots

- Cartesian Robots

- Others

By Application

- Material Handling

- Welding

- Painting

- Cutting

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Competitive Landscape

The North America Automotive Robotics Market is highly competitive with companies focusing on:

- AI-powered robotic innovation

- Collaborative robot development

- Strategic manufacturing partnerships

- Facility expansion investments

- Product portfolio diversification

Leading players are enhancing automation ecosystems to support the next generation of electric and autonomous vehicles.

Key Market Players

Major companies operating in the market include:

ABB Ltd, Rockwell Automation Inc., Yaskawa Electric Corp, FANUC Corporation, Harmonic Drive Systems Inc., Nachi-Fujikoshi Corp., Universal Robots, and Comau S.p.A.

These companies emphasize technological advancements, regional expansion, strategic collaborations, and cost-efficient automation solutions.

Conclusion and Future Outlook

The North America Automotive Robotics Market is set for strong and sustained growth through 2033, driven by:

- Expanding EV manufacturing

- Rising automation demand

- Technological innovation

- Industry 4.0 transformation

- Safety optimization initiatives

Although initial investment and regulatory hurdles persist, ongoing advancements in AI robotics, collaborative automation, smart manufacturing ecosystems, and digital factory integration will continue to propel market momentum.

Automotive robotics will remain a cornerstone of North America’s industrial evolution, supporting faster production, superior quality, safer operations, and globally competitive automotive manufacturing in the coming decade.