Expanding into international markets is an exciting milestone for any business, but it also brings a new set of financial challenges. Managing cross-border payments, protecting cash flow, handling currency risks, and ensuring timely settlement can quickly become complex without the right support. This is where import export financing and corporate trade finance solutions play a critical role. A reliable trade finance company like MCB helps businesses move beyond domestic boundaries by offering structured global trade solutions that support growth, stability, and long-term success.

Understanding Import Export Financing

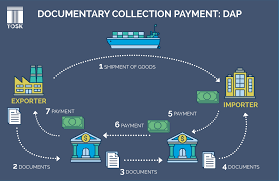

Import export financing refers to the financial facilities that enable businesses to buy and sell goods across international borders without straining their working capital. When goods travel thousands of miles and payments are delayed due to shipping, customs, or regulatory checks, businesses need financial flexibility to continue operating smoothly.

Through import export financing, companies can access short-term funding, payment guarantees, and settlement support that bridge the gap between shipment and payment. This allows exporters to receive funds on time and importers to pay suppliers without disrupting cash flow. For businesses scaling internationally, this financing becomes a strategic necessity rather than a convenience.

Why Corporate Trade Finance Solutions Matter

Corporate trade finance solutions are designed to support larger, more complex trade transactions involving multiple countries, currencies, and counterparties. Unlike basic trade financing, these solutions are tailored to a company’s operational scale, industry requirements, and growth objectives.

A strong trade finance company provides corporate clients with structured instruments that reduce risk, enhance trust between trading partners, and ensure compliance with international banking standards. These solutions support not just individual transactions, but entire supply chains, enabling companies to expand into new markets with confidence.

MCB as a Strategic Trade Finance Partner

MCB plays a vital role in supporting businesses that aim to scale globally by offering comprehensive global trade solutions. Rather than providing one-size-fits-all products, MCB focuses on understanding the specific needs of importers, exporters, and corporate clients. This consultative approach allows businesses to access trade finance solutions that align with their operational realities and expansion goals.

By combining financial expertise with digital capabilities, MCB helps companies simplify international trade processes, manage risks effectively, and maintain liquidity across borders. This partnership approach makes MCB more than just a financing provider, it becomes a growth enabler.

Key Import Export Financing Solutions Offered by MCB

MCB offers a wide range of import export financing solutions designed to support businesses at every stage of the trade cycle. These solutions help manage payment timelines, protect against counterparty risk, and ensure seamless trade execution.

For importers, financing solutions allow deferred payments while ensuring suppliers are paid on time. This helps businesses maintain supplier relationships without locking up capital. For exporters, financing ensures timely access to funds after shipment, improving cash flow and reducing dependence on advance payments.

These facilities are especially valuable for businesses entering new international markets where payment terms may be unfamiliar or negotiation leverage is still developing.

Corporate Trade Finance Solutions for Growing Enterprises

As businesses grow, trade transactions become larger and more complex. Corporate trade finance solutions offered by MCB are structured to handle high-value transactions, multi-party agreements, and long-term contracts.

These solutions include support for documentary trade instruments, guarantees, and performance-based financing that protect both buyers and sellers. By structuring transactions carefully, MCB helps reduce disputes, improve transaction transparency, and ensure that obligations are met according to agreed terms.

For corporations managing global supply chains, this level of financial structure ensures continuity and operational stability, even in volatile market conditions.

Supporting Global Trade Solutions Through Digital Innovation

Scaling internationally requires more than financial backing. It demands speed, transparency, and control. MCB supports global trade solutions by integrating digital platforms that streamline trade documentation, approvals, and transaction tracking.

Digital trade finance tools allow businesses to manage trade operations efficiently, reduce paperwork, and gain real-time visibility into transaction status. This improves decision-making and reduces delays caused by manual processing or communication gaps.

For companies expanding into multiple regions, digital access to trade finance services becomes a competitive advantage, enabling faster execution and better coordination with global partners.

Risk Management and Compliance in International Trade

One of the biggest challenges in international trade is managing risk. Currency fluctuations, regulatory changes, political uncertainty, and counterparty reliability can all impact transaction outcomes. A trusted trade finance company plays a crucial role in mitigating these risks.

MCB helps businesses structure trade finance solutions that protect against payment defaults and contractual non-performance. At the same time, strong compliance frameworks ensure adherence to international trade regulations, reducing legal and operational exposure.

This balance of risk management and regulatory support allows businesses to focus on growth rather than uncertainty.

How MCB Helps Businesses Scale Internationally

Scaling internationally requires a financial partner that understands both local markets and global trade dynamics. MCB supports businesses by aligning import export financing with long-term corporate trade finance strategies.

By offering flexible financing options, expert advisory support, and reliable global trade solutions, MCB enables companies to enter new markets with confidence. Businesses can negotiate better payment terms, strengthen supplier relationships, and improve cash flow predictability.

This holistic approach ensures that international expansion is sustainable, controlled, and aligned with the company’s broader business goals.

The Competitive Advantage of a Trusted Trade Finance Company

Choosing the right trade finance company can define the success of a business’s international journey. A strong partner provides more than capital. It delivers insight, structure, and long-term reliability.

MCB’s trade finance expertise helps businesses move beyond transactional support and build resilient international operations. With the right import export financing and corporate trade finance solutions in place, companies gain the confidence to explore new markets, diversify supply chains, and scale globally.

Conclusion

International expansion demands financial clarity, operational control, and strategic support. Import export financing and corporate trade finance solutions provide the foundation businesses need to grow across borders without compromising stability. As a trusted trade finance company, MCB delivers global trade solutions that empower businesses to scale internationally, manage risk effectively, and unlock new opportunities in global markets.