Introduction:

The construction industry is booming due to huge investments in public and private infrastructure and development projects, the so-called “mega projects.” To contractors, these mega-projects symbolize the ultimate achievement and expansion. But successful bidding and execution of such contracts require more than technical capabilities; they must be supported by a strong guarantee both financially and operationally. Central to this is the Performance Bond.

Performance Bond:

The Performance Bond is not simply a formality; it is a key that unlocks the doors to mega and high-value projects. To the contractor, mastering bonding is tantamount to scaling their business to the mega-project level. The guide explains what performance bonds are, why they may be indispensable in mega-projects, and how contractors can take advantage of the bonds strategically to win and execute their most ambitious work.

What is a Performance Bond?

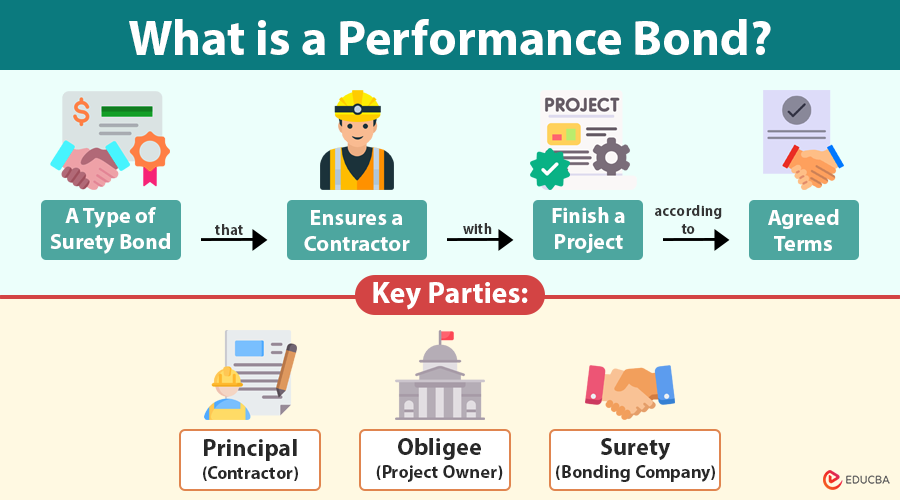

The performance bond, in simple terms, is a surety bond that ensures the contractor will complete a construction project in accordance with the contract terms and conditions.

In essence, it forms an agreement between three parties:

- The Principal: The contractor awarded the project.

- The Obligee: A project owner or client, e.g., government agency or real estate developer.

- Surety: The insurance company or bank that issues the bond.

The bond safeguards the Obligee financially against defaults of the Principal, which includes failure to meet deadlines, substandard work, or bankruptcy; in such cases, the Surety undertakes the completion of the project or pays compensation to the Obligee for financial loss up to the bond value.

On mega-projects, the bond amount is often 100% of the contract value, and the stakes for all three parties are unusually high. For the contractor, the bond takes an otherwise straightforward promise and turns it into a legally binding, financially backed guarantee of performance.

Why Performance Bonds are Non-Negotiable for Mega-Projects:

By definition, mega-projects involve very large scales, intricate complexity, and often hundreds of millions of dollars in contract value. The project owners, investors, and financing institutions require the highest possible assurance that their huge capital investment is secure.

- Risk Mitigation and Financial Security:

Mega-projects take years, and the financial landscape can change dramatically. A performance bond offers essential protection from the risk of default, insolvency, or abandonment by the contractor to the Obligee. This ensures that, in the event of any failure, funds are available to bring a replacement contractor to complete the work.

- Pre-Qualification and Credibility:

Being able to obtain a 100% Performance Bond for a mega-project is a rigorous prequalification process in itself. The Surety performs an extremely thorough review of the contractor’s “three Cs”:

- Character: The contractor’s integrity and track record.

- Capacity: Contractor’s operational ability, equipment, and management systems.

- Capital: The contractor’s financial strength, liquidity, and ability to handle large-scale financial commitments.

A contractor who is bondable for a mega-project is immediately viewed as credible, financially stable, and operationally capable-a powerful competitive advantage in the bidding process.

- Securing Project Financing:

In privately funded mega-projects, lenders and investors usually require Performance Bonds prior to releasing funds for construction. It gives the financial institutions an added layer of security; thus, making the whole project easier and less expensive to finance. Without such assurance, the financing of projects is often impossible.

A Contractor’s Strategic Guide to Winning and Delivering Bonded Mega-Projects:

It requires a shift in focus for a contractor interested in winning mega-projects from simply getting a bond to strategic maximization of bond capacity and optimization of project delivery to protect that capacity.

Step 1: Maximize Your Bonding Capacity:

Your bonding capacity is the maximum aggregate value of uncompleted work that your surety is willing to guarantee. In order to free up enough capacity to take on even a single mega-project, a contractor must achieve financial and operational excellence:

- Improve Financial Health: Have strong, liquid financial statements. Sureties like companies with a strong working capital position (current assets minus current liabilities) and a good debt-to-equity ratio. Retain earnings in the company instead of distributing too much in dividends.

- Retain a Construction-Focused CPA: Employ the services of a Construction-focused Certified Public Accountant (CPA). They are familiar with construction’s special financial reporting standards and are able to present financial statements in the most surety-friendly format possible. If the bond is greater than some threshold amount, usually \$1.5 million, an audited financial statement prepared by a CPA is required.

- Establish a Relationship with a Surety Agent: The surety agent should be experienced and match your company’s goals and mega-project needs. He or she is your advocate, presenting your case to the underwriters, while also guiding you through complicated bonding requirements.

- Keep Your Performance Record Clean: Each completed project represents one data point. Delivering projects on time, within budget, and with no claims remains the surest way to build trust, and therefore bonding capacity.

Step 2: Strategic Bidding and Contract Review:

Any decision to bid on a mega-project must be made in consultation with your surety.

- Prequalification: Before submitting the formal bid, you need to prequalify for the required Bid Bond, which guarantees that in case of winning, you shall enter the contract and provide a Performance Bond. It’s the litmus test of your subsequent eligibility for the Performance Bond.

- Know Your Limits: Never overextend your bonding capacity. Bidding on a project which stretches your limits without having a clear plan regarding how the existing work will be handled will raise a red flag for the surety.

- Scrutinize the Contract: A performance bond is intrinsically related to an underlying contract. Ensure that terms are clear, fair, and achievable. Review clauses related to payment schedules, change orders, dispute resolution, and liquidated damages, as those items can directly impact the likelihood of a claim.

Step 3: Flawless project execution and communication:

After a mega-project is won and the bond is issued, the fundamental objective of any contractor is to perform perfectly so as not to create any claim against the bond.

- Superior project management should be implemented: Mega-projects require the use of sophisticated systems for scheduling, quality control, cost management, and risk identification. Monitoring should be performed against contractual milestones, using state-of-the-art software and highly competent project managers.

- Document Everything: Any contractual dispute is won on the basis of documentation. Keep extensive records regarding job activity, communications, change orders, delays, and inspections. It is essential not only in winning disputes on projects but also in defending against any claim that may be asserted by the Obligee against the Surety.

- Open Communication with the Surety: Don’t wait until there is a problem before calling your surety. Provide regular status reports about the project, but especially a detailed WIP. Transparency builds trust, and early communication allows the surety to offer advice or intervene before a minor problem becomes a default.

Here are some performance bond companies, bank guarantee finance, financial instruments providers, and trade finance in Thailand:

- ThaiBMA (Thai Bond Market Association) is a securities business related association under the Securities and Exchange Commission Act.

- Bangkok Bank is the best trade finance bank in Thailand.

- Krungsri (Bank of Ayudhya PCL) provides bank guarantee and counter guarantee services.

- Bank of China (Thai) Public Company Limited (BOCT) offers bank guarantee and counter guarantee services .

Conclusion:

In the world of mega-projects, a Performance Bond is more than a financial product; it’s a certificate of excellence for the contractor. It gives assurance to the Obligee that the project will be completed, protects the investor’s capital, and most importantly allows the contractor to compete at the highest level of the industry.

For More Information Visit : https://oxfordinternationalbank.com/